Choosing the right business structure for your social media marketing agency is important because it will affect your legal, financial, and personal responsibilities. Here are some things to think about when setting up your social media marketing agency’s business structure. Moreover, there are many different ways to set up a business, and each has its own pros and cons. Here is a rundown of the main business structures and their pros and cons:

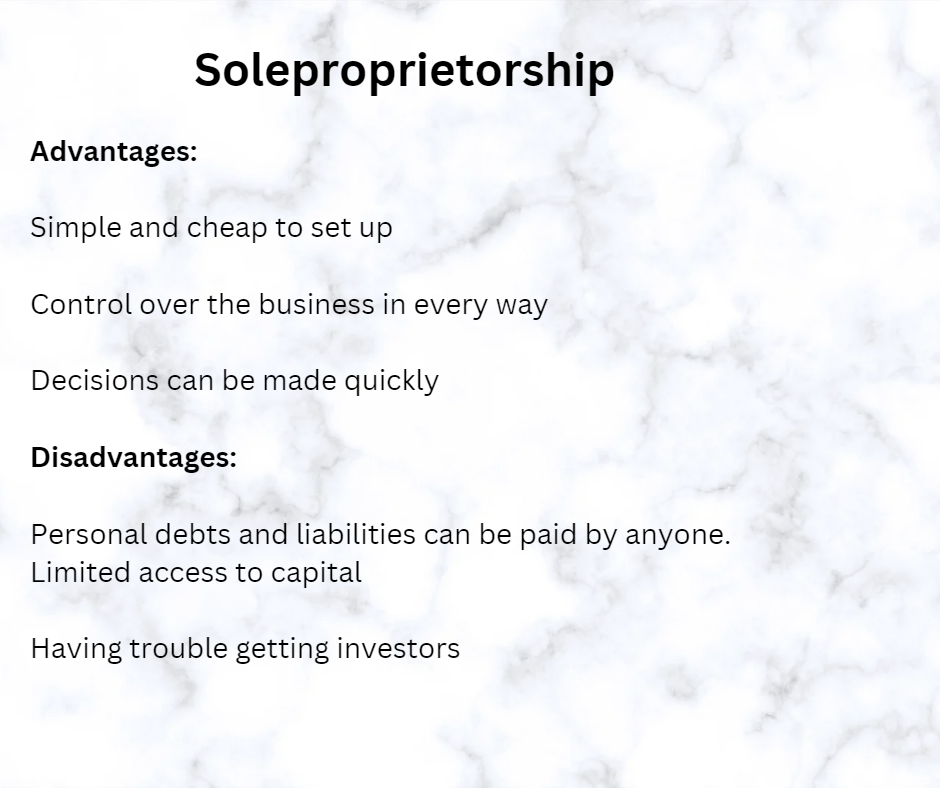

1. Sole proprietorship

One person owns a sole proprietorship, which is the simplest type of business structure. It’s easy to set up and gives the owner full control over the business, but the owner is personally responsible for all debts and liabilities.

Advantages:

- Simple and cheap to set up

- Control over the business in every way

- Decisions can be made quickly

Disadvantages:

- Personal debts and liabilities can be paid by anyone.

- Limited access to capital

- Having trouble getting investors

Related Reading 6 Business Ventures that Require Zero Capital.

2. Partnership

A partnership is a business that is owned by two or more people. There are two types of partnerships: general partnerships and limited partnerships. In a general partnership, all partners are equally responsible for the business, while in a limited partnership, some partners have limited liability.

Advantages:

- Simple and cheap to set up

- Decisions and responsibilities are made together.

- Possible to split profits

Disadvantages:

- Personal debts and liabilities can be paid by anyone (in a general partnership)

- There could be problems between partners.

- Limited access to capital

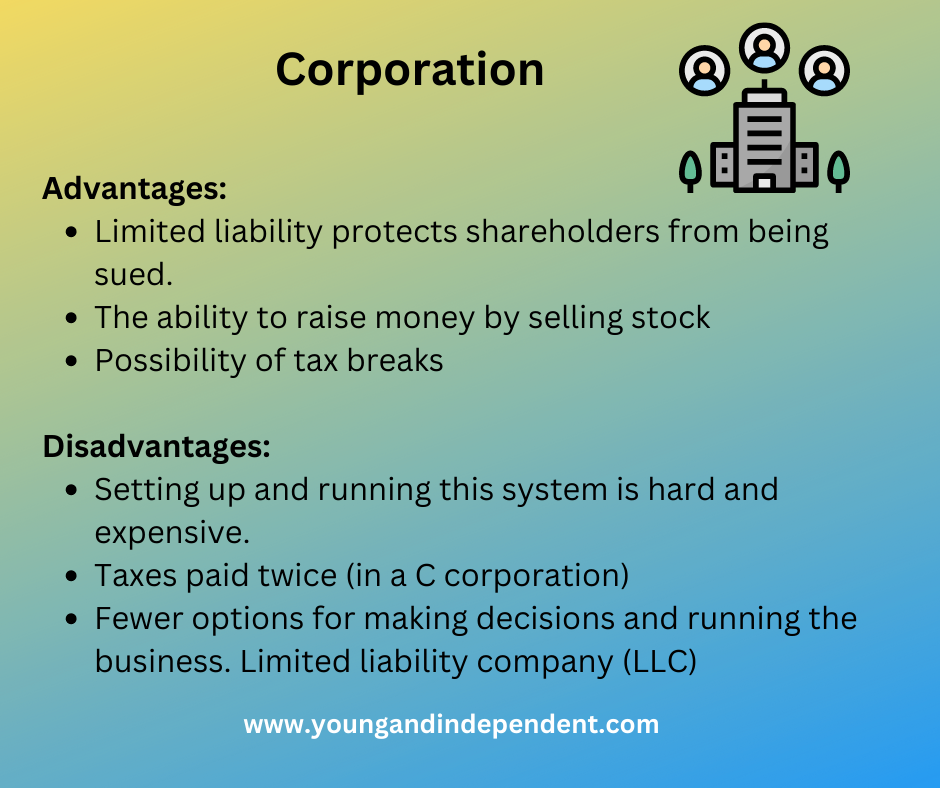

3. Corporation

Corporation: A corporation is a separate legal entity from the people who own it, and it protects its shareholders by limiting their liability. There are different kinds of corporations, such as C corporations and S corporations.

Advantages:

- Limited liability protects shareholders from being sued.

- The ability to raise money by selling stock

- Possibility of tax breaks

Disadvantages:

- Setting up and running this system is hard and expensive.

- Taxes paid twice (in a C corporation)

- Fewer options for making decisions and running the business.

4. Limited liability company (LLC):

An LLC is a hybrid business structure that combines the limited liability protection of a corporation with the tax benefits of a partnership or sole proprietorship.

When choosing a business structure, it’s important to think about your personal liability, the tax effects, your financial and management needs, and how you want to run the business. You might want to talk to a lawyer or financial advisor to figure out how to set up your social media marketing agency in the best way.

Advantages:

- The owners have limited liability protection

- Taxed as a partnership or as a single-owner business (depending on the number of owners)

- Management and decision-making that are open to change

Disadvantages:

- Setting up and running a corporation is more expensive and complicated than a sole proprietorship or partnership.

- Stock sales can only bring in a small amount of money.

When choosing a business structure, it’s important to think about your personal liability, the tax effects, your financial and management needs, and how you want to run the business. You might want to talk to a lawyer or financial advisor to figure out the best way to set up your business.